Understanding Tractor Loan Interest Rates

Buying a new tractor is a significant investment for any farmer, especially those committed to sustainable agriculture. Securing the right financing is crucial for long-term success. This guide provides actionable steps to help you navigate the complexities of tractor loan interest rates and secure the best financing for your farm. For farmers with less-than-perfect credit, explore options like bad credit tractor loans.

Decoding Interest Rates: APR and Loan Terms

The interest rate on your tractor loan is essentially the "rent" you pay for borrowing money. It's usually expressed as an Annual Percentage Rate (APR), encompassing all fees. A higher APR means a more expensive loan overall. Your specific APR depends on several factors, including your credit history, the loan's length (term), and the lender. Longer loan terms typically mean lower monthly payments but higher total interest paid. Conversely, shorter terms mean higher monthly payments but less overall interest.

Did you know? A study by [Insert Source and Data Here - e.g., the USDA] shows that farmers with excellent credit scores typically obtain APRs [range] lower than those with fair credit, who may face rates of [range].

Exploring Financing Options: Beyond Bank Loans

Several avenues exist for financing your tractor. Each possesses unique advantages and disadvantages.

Conventional Bank Loans: These are common, with interest rates dependent on your creditworthiness, the loan amount, and market conditions. A strong credit history is key to securing competitive rates.

Government-Backed Loans: Agencies like the USDA offer programs tailored towards farmers, often featuring lower interest rates and flexible repayment terms. These programs often prioritize sustainable agricultural practices. Eligibility requirements vary.

Leasing: Leasing avoids large upfront costs, making it ideal for farmers who prefer not to commit to ownership long-term or anticipate needing upgrades. However, you'll ultimately pay more over the life of the lease than in a purchase.

Alternative Financing: Crowdfunding and grants targeted at sustainable agriculture projects are gaining traction, offering alternative funding sources.

Quantifiable Fact: According to [Insert Source and Data Here - e.g., a recent survey of sustainable farmers], [Percentage]% utilized alternative financing methods in addition to traditional bank loans to acquire equipment.

Creating a Comprehensive Financial Plan

Before applying for loans, meticulously plan your finances. This approach enhances your chances of securing favorable loan terms and prevents financial setbacks.

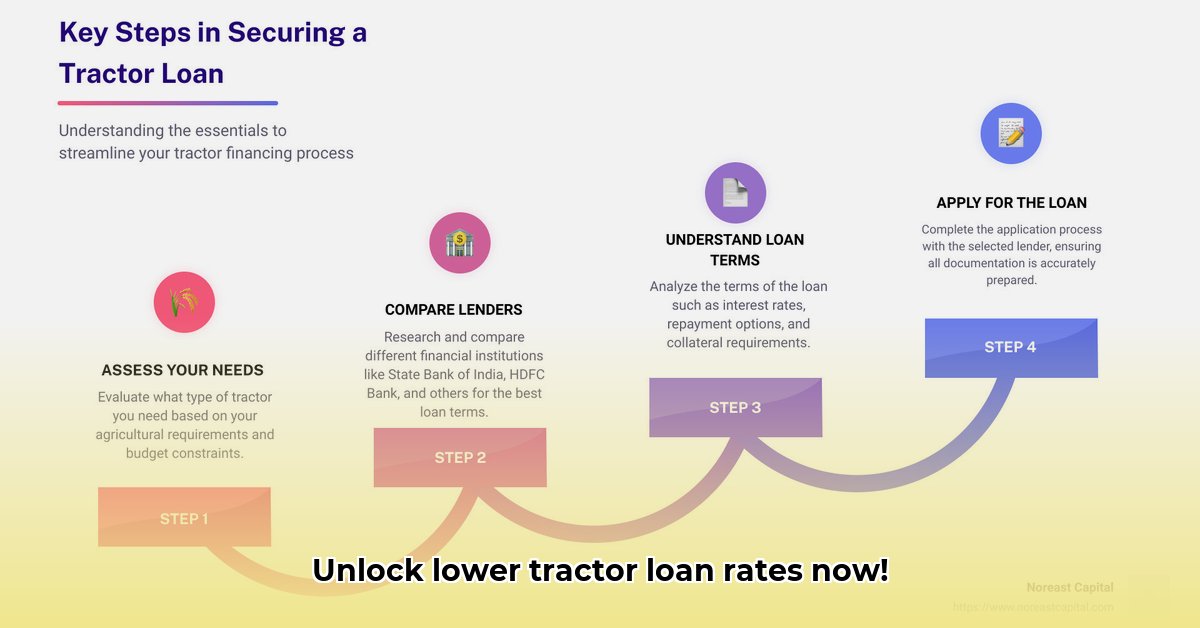

Step-by-Step Financial Planning

Assess Tractor Needs: Identify your specific tractor requirements and obtain detailed price quotes from various dealers. Consider features essential for sustainable operations.

Calculate Down Payment: A substantial down payment often reduces the loan amount, thereby impacting your interest rate positively.

Shop for Loans: Compare APRs, loan terms, and associated fees from multiple lenders. Consider both traditional and agricultural lenders.

Factor in Operating Costs: Include maintenance, fuel, insurance, and other related expenses in your budget. This creates a realistic financial outlook.

Project Your Income: Estimate the productivity boost from the new tractor. Project realistic yield increases and their impact on your farm's income, demonstrating your ability to repay the loan.

Rhetorical Question: Have you considered the potential impact of increased efficiency on your overall farm profitability when planning your loan application?

Minimizing Financial Risks: Proactive Strategies

Farming entails inherent risks. Strategic planning can mitigate these risks, particularly when financing significant purchases.

Risk Mitigation Strategies

Diversification: Cultivate diverse crops or livestock to lessen your dependence on single commodities and soften the blow of price fluctuations.

Crop Insurance: Insure against unpredictable losses due to weather or other unforeseen events.

Emergency Fund: Establish a financial reserve to handle unexpected expenses, providing a buffer against potential income shortfalls.

Expert Quote: "Diversification is paramount in mitigating risk within sustainable agriculture," states Dr. [Name], Professor of Agricultural Economics at [University]. "It's not just about protecting your investment; it’s about securing the longevity of your farm."

Resources and Further Reading

USDA Farm Service Agency (FSA): https://www.fsa.usda.gov/

State Cooperative Extension Services: Contact your local university extension office for tailored advice and resources.

Remember, this is a general guide. Seek advice from a financial advisor specializing in agricultural financing before making significant financial decisions. They can help create a personalized plan aligning with your circumstances and goals. Informed decision-making about tractor loan interest rates is paramount to building a resilient and prosperous sustainable farm.